PROBABILITY OF DEFAULT

PAKDD 2010

In 2010, TIMi took part in the Pacific-Asia international competition on Knowledge Discovering from Database. The objective of the competition was to create a predictive model used inside a Credit Risk Assessment System.

In Brazil, there is a high demand for credit cards. Unfortunately, some people never pay pack their expenses, they just disappear. The objective was to create a model that predicts if somebody won’t pay its debts. The same predictive model can be used to predict defaults on other credit card, loans or any type of credit.

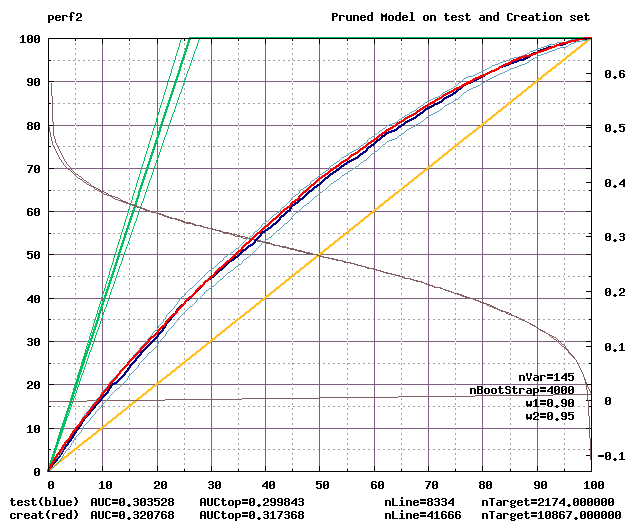

The prediction targets are the clients that do not pay their debt (bad clients). A client is labeled as bad if he made 60 days delay in any payment of the bills contracted along the first year after the credit has been granted. The performance of the predictive model used to compute the final ranking of the teams was measured using area under the receiver operating characteristic curve (AUC) on the Prediction data set of 20,000 further accounts.

TIMi ranking

TIMi obtained the 7th place amongst a total of 94 teams.

| PAKKD 2010 Results | |||

| Ranking | Team Name | Institution | AUC_ROC |

| 1 | GH (Grzegorz Haranczyk) | GH | 0.645 |

| 2 | Winners(Navin Loganathan,Ranjani Subramaniam, Shobha Prabhakar, Sankar Deivanayagam) | LatentView Analytics | 0.641 |

| 2 | Latentview (Priya Balakrishnan, Kiran.PV, Syluvai Anthony, Mahadevan Balakrishnan) | LatentView Analytics | 0.641 |

| 4 | uq (Vladimir Nikulin) | University of Queensland | 0.638 |

| 5 | Tabnak (Yasser Tabandeh) | Shiraz University | 0.637 |

| 6 | Wiggle Puppy (Daniel Felix) | Independent | 0.634 |

| 7 | Kranf (Frank Vanden Berghen) | TIMi | 0.633 |

| 7 | TZTeam (Didier Baclin) (also using TIMi) | None | 0.633 |

| 7 | Mjahrer (Michael Jahrer) | Commendo Consulting | 0.633 |

| 10 | Abhyuday (Abhyuday Desai) | Kiran Analytics,Inc. | 0.629 |

| 10 | iDO95 (Max Wang, Amy Yu) | Alliance Data | 0.629 |

Source: PAKDD 2010

BANKING CUSTOMERS

Cofidis

BVBA Continental

Scotiabank

Axa

Crelan

Inversiones La Cruz

Euroclear

ING

Beobank

Mornese

Credinka